The Basic Principles Of Feie Calculator

Wiki Article

The Greatest Guide To Feie Calculator

Table of Contents8 Easy Facts About Feie Calculator DescribedAll about Feie CalculatorThe Ultimate Guide To Feie CalculatorMore About Feie CalculatorOur Feie Calculator StatementsSome Known Incorrect Statements About Feie Calculator Things about Feie Calculator

If he 'd regularly taken a trip, he would certainly instead finish Part III, providing the 12-month period he fulfilled the Physical Presence Test and his travel background. Action 3: Coverage Foreign Earnings (Part IV): Mark made 4,500 per month (54,000 each year).Mark calculates the exchange rate (e.g., 1 EUR = 1.10 USD) and converts his wage (54,000 1.10 = $59,400). Since he resided in Germany all year, the percentage of time he stayed abroad during the tax is 100% and he enters $59,400 as his FEIE. Ultimately, Mark reports complete incomes on his Form 1040 and goes into the FEIE as a negative quantity on Set up 1, Line 8d, lowering his gross income.

Selecting the FEIE when it's not the very best choice: The FEIE may not be suitable if you have a high unearned income, make more than the exclusion restriction, or live in a high-tax country where the Foreign Tax Obligation Credit (FTC) might be more helpful. The Foreign Tax Obligation Credit Score (FTC) is a tax obligation reduction method typically used together with the FEIE.

All About Feie Calculator

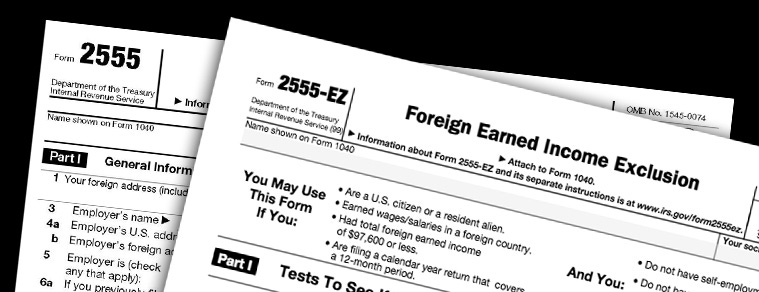

expats to counter their united state tax financial debt with foreign income tax obligations paid on a dollar-for-dollar reduction basis. This suggests that in high-tax nations, the FTC can typically get rid of U.S. tax debt totally. The FTC has restrictions on eligible taxes and the maximum insurance claim quantity: Eligible tax obligations: Only income tax obligations (or tax obligations in lieu of income tax obligations) paid to international federal governments are qualified (Form 2555).tax liability on your international revenue. If the international tax obligations you paid surpass this limit, the excess international tax can usually be continued for as much as 10 years or brought back one year (by means of a changed return). Preserving exact records of foreign income and tax obligations paid is consequently crucial to determining the appropriate FTC and preserving tax conformity.

expatriates to reduce their tax responsibilities. For example, if an U.S. taxpayer has $250,000 in foreign-earned income, they can omit as much as $130,000 using the FEIE (2025 ). The staying $120,000 may after that be subject to tax, yet the U.S. taxpayer can possibly apply the Foreign Tax Credit score to offset the tax obligations paid to the foreign nation.

Some Known Factual Statements About Feie Calculator

Initially, he sold his united state home to develop his intent to live abroad completely and made an application for a Mexican residency visa with his spouse to aid accomplish the Bona Fide Residency Test. Additionally, Neil protected a long-term residential property lease in Mexico, with strategies to eventually buy a residential property. "I currently have a six-month lease on a house in Mexico that I can expand one more 6 months, with the intent to purchase a home down there." Nonetheless, Neil explains that purchasing residential property abroad can be testing without first experiencing the area."It's something that people require to be actually attentive concerning," he says, and suggests expats to be careful of common errors, such as overstaying in the United state

Neil is careful to mindful to Tension tax authorities that "I'm not conducting any carrying out any kind of Company. The United state is one of the few countries that taxes its citizens regardless of where they live, indicating that also if a deportee has no revenue from U.S.

The Best Strategy To Use For Feie Calculator

tax returnTax obligation "The Foreign Tax Debt allows people working in high-tax countries like the UK to offset their United state tax obligation obligation by the amount they've currently paid in tax obligations abroad," claims Lewis.The prospect of lower living prices can be tempting, but it typically comes with compromises that aren't quickly evident - https://www.kickstarter.com/profile/279303454/about. Housing, for instance, can be a lot more inexpensive in some nations, yet this can mean jeopardizing on infrastructure, security, or access to trustworthy energies and services. Affordable homes could be located in areas with irregular net, limited mass transit, or unstable health care facilitiesfactors that can significantly impact your everyday life

Below are some of the most often asked inquiries about the FEIE and other exclusions The Foreign Earned Earnings Exemption (FEIE) permits U.S. taxpayers to exclude as much as $130,000 of foreign-earned income from government earnings tax obligation, reducing their united state tax obligation obligation. To get FEIE, you have to fulfill either the Physical Visibility Test (330 days abroad) or the Authentic Residence Examination (prove your primary residence in a foreign nation for a whole tax year).

The Physical Presence Examination needs you to be outside the united state for 330 days within a 12-month period. The Physical Presence Examination additionally calls for united state taxpayers to have both an international revenue and an international tax home. A tax home is specified as your prime location for organization or work, regardless of your family members's house. https://feiecalcu.creator-spring.com/.

More About Feie Calculator

An earnings tax obligation visit homepage treaty between the U.S. and one more country can help stop double taxation. While the Foreign Earned Revenue Exemption decreases taxable income, a treaty may supply fringe benefits for qualified taxpayers abroad. FBAR (Foreign Savings Account Record) is a called for declaring for united state residents with over $10,000 in international economic accounts.

The international earned income exclusions, occasionally referred to as the Sec. 911 exclusions, exclude tax obligation on wages gained from functioning abroad.

The 2-Minute Rule for Feie Calculator

The income exemption is now indexed for inflation. The optimal yearly revenue exclusion is $130,000 for 2025. The tax obligation advantage omits the income from tax obligation at bottom tax obligation rates. Previously, the exemptions "came off the top" reducing revenue based on tax obligation on top tax prices. The exclusions might or might not reduce earnings used for various other purposes, such as IRA restrictions, child credit scores, individual exemptions, etc.These exemptions do not spare the wages from US taxation yet simply provide a tax decrease. Note that a solitary individual working abroad for every one of 2025 who made concerning $145,000 without any various other revenue will have gross income decreased to absolutely no - efficiently the same answer as being "free of tax." The exclusions are calculated on an everyday basis.

If you participated in organization meetings or seminars in the US while living abroad, earnings for those days can not be left out. Your incomes can be paid in the US or abroad. Your company's area or the place where wages are paid are not variables in receiving the exclusions. American Expats. No. For US tax it does not matter where you maintain your funds - you are taxed on your globally revenue as a United States individual.

Report this wiki page